My Hive Power is about to reach 12,000 HP. I am still 40 HP shy of the mark. I figure I will likely reach the goal in early September. I am thinking about the significance of this milestone. I had plans for what to do once I reached 12K HP. However, the current circumstances are making me reconsider.

If you are reading this post on my blog at shainemata.com, then you may not be aware the my blog posts are written to the Hive blockchain, which rewards my posts with HIVE coins. These coins can be converted to Hive Backed Dollars (HBD), a stablecoin of the same blockchain. As my rewards accumulate, so does my clout on the blockchain. This permits me to earn more rewards and to reward others in the way you would roll a snowball to increase its size. There's a whole other syndicated world that is not obvious just by looking at my blog.

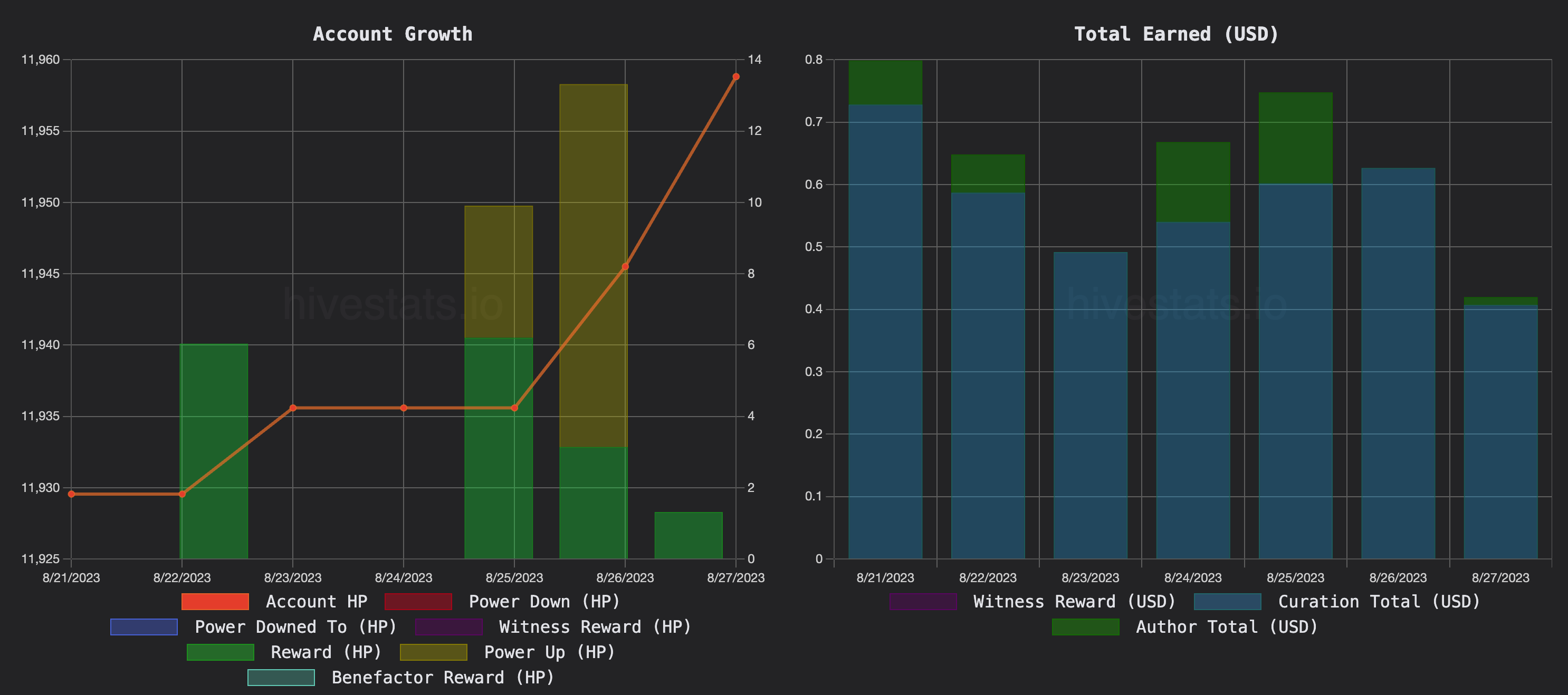

Image from Hivestats.io

The Old Plan

My plan was to start cashing out some HP and converting the HIVE to HBD to grow my savings when I reached 12,000 HP. At this stage, I'm earning about 1 HP per day from inflation and another 1 HP per day from curation. When I post, those earnings are extra. So, I was thinking of just withdrawing about 7 HP per week to convert to HBD. Then whatever interest payments I earned from my deposits could be withdrawn and spent. At this rate, my HP would continue to grow, except a bit slower. But a portion of my earnings would go towards building HBD savings, which is currently growing at 20% interest. This would be a long-term effort to grow cash flow from HBD interest.

Change in Circumstances

Mike Tyson is quoted as saying, "Everybody has a plan until they get punched in the mouth". And, in this case, the bear market has brought the price of HIVE under $0.30, which is buy territory. Not only would cashing out 7 HP weekly only yield me about $2 per week, I would be missing out on the potential growth of the 2024 bull market. If I postpone my plan, I may have grown to about 14,000 HP by the end of next year.

However, I'm not entirely convinced. At today's HIVE price, I would surely get about $2 per week for savings. With HBD rewards from blog posts, I'd earn more than the $8 monthly. Over time, this stuff builds up. But once the price of HIVE increases during the bull market, that weekly $2 would go up too. If HIVE were to reach $1, then I would potentially earn $7 in HBD weekly, or $28 monthly to deposit into savings. We're not talking crazy numbers here. But, over many years, it adds up. Not to mention that my HP would be worth roughly $12,000 too.

Locking in Gains

The overall concept of diverting some of my HP earnings into HBD savings is to lock away gains, which I think may of us on Hive are expecting next year. We have seen our crypto portfolios grow to some exciting levels, only to decline to where we are today. We know it's a cycle based on the Bitcoin halving. Yet we largely fail to systematically lock in our gains.

This is what got me to thinking about systematically setting aside savings once I reached 12,000 HP. Sure, my HP growth would be slower. But I would also lock in some gains, which would still be growing at a steady 20%.

Undecided

I have not decided what I'll do when I reach 12,000 HP. I might just forge ahead to grow my account, then cash out a lump sum of HP to deposit in HBD savings in late 2024. It's not a decision I need to make right away. However, by reaching this milestone, it's something to consider.